Inflation, Shrinkflation & Skimpflation: Prices Going Higher, Packages Getting Smaller, Service Getting Worse

Skimpflation. You may not have heard of it, but shoppers are feelings its effects.

NPR's Planet Money podcast coined the term to describe the present "economywide decline in service quality," AKA the many ways companies cut corners to account for labor shortages and rising prices.

- Spending more time on hold with your bank these days? That's skimpflation.

- Is your hotel not changing out towels? Skimpflation.

- Longer lines at the drive-thru? Thanks a lot, skimpflation.

And it's not much different in the world of aisles, endcaps, and SKUs.

With reduced staff, stores might prioritize stocking shelves over, say, cleaning bathrooms. And with fewer drivers available, you might be waiting longer than usual for that grocery delivery.

Of course, skimpflation is hardly an isolated issue. It's closely tied to a changing labor market, supply chain issues, and its cousin "shrinkflation" (i.e. reducing the size or amount of a product sold, without reducing the price).

For all this belt-tightening and cost-cutting, retailers and brands are working hard to make skimpflation as unnoticeable as possible for their customers.

But are shoppers noticing? If they are, what do they think about skimpflation, and how are they responding?

We put the questions to the shoppers themselves.

The Skimpflation Survey

To understand the shopper's perspective on skimpflation, we surveyed 1,554 Canadian adults through the Field Agent platform, February 1st to 6th. Specifically, we sought to understand the role of skimpflation on Canadians as they shop in-store for groceries and household consumables.

Let's explore the results...

1. Are shoppers noticing "cuts" in customer service?

It's true: skimpflation has reared its ugly head, and shoppers have noticed.

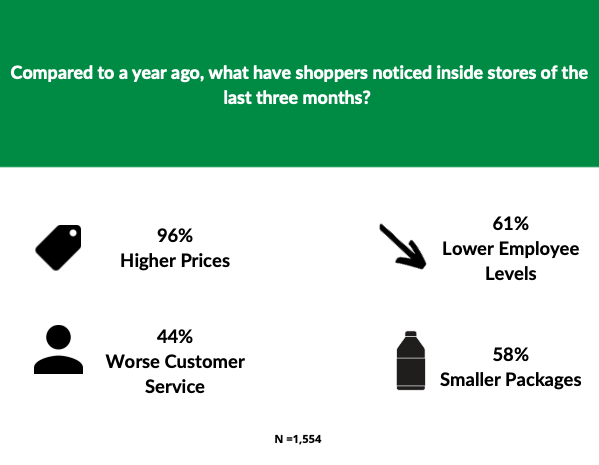

Our survey asked respondents to compare their in-store shopping experiences from the past three months to their experiences just a year ago. Nearly two out of three shoppers (61%), we found, had noticed fewer employees in stores these past few months, and nearly half (44%) said they have experienced worse customer service lately.

So, yeah, you could say shoppers are noticing skimpflation—whether fewer employees in-store or, more generally, a decline in customer service.

The survey results also make clear just how challenging everyday shopping has become the last several months.

As you can see in the graphic, 96% of respondents have noticed higher prices while shopping in stores lately, compared to 58% who have noticed smaller packages (i.e., shrinkflation).

2. How is customer service suffering?

Two problems make up the beating heart of skimpflation: tight cash and limited staff. Retailers are feeling the pinch, and some of the associated costs have to be passed along to shoppers.

Practically speaking, where do shoppers see retailers cutting corners?

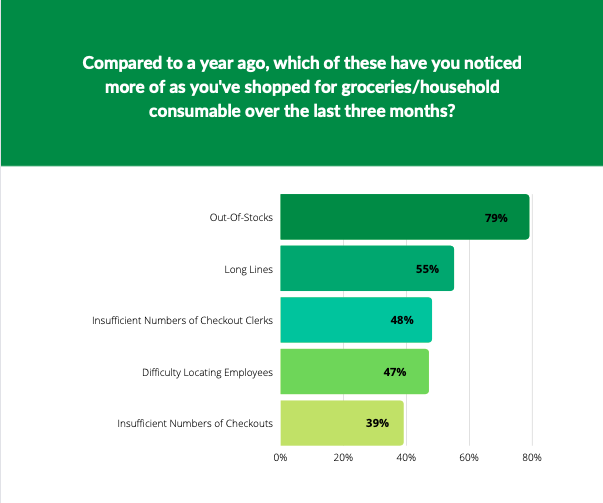

At the top of the list, four in five shoppers have noticed out-of-stocks on store shelves, thanks to both labor shortages (meaning products don't make it to the shelf) and an ongoing supply chain crisis (meaning products don't make it to the store).

The majority of shoppers have also noticed issues as they check out—longer lines (55%), fewer checkout clerks (48%), and scant checkout stations (39%).

In the words of one shopper, Betty V. from Markham, ON:

"Customer service has gotten very poor the past few years. I find the people are not as friendly and will not interact with you much. I find there are less workers available to help out.”

Betty, clearly, is not alone.

3. How are shoppers responding to skimpflation?

"Every action has an equal and opposite reaction." So we're told.

What, then, is the reaction to skimpflation?

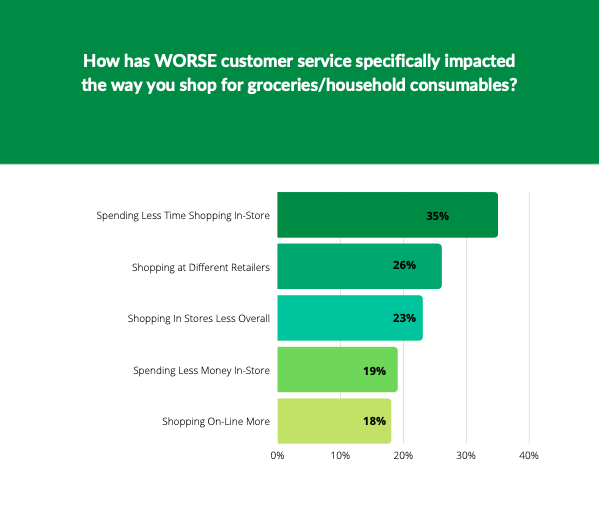

We posed this question to n = 678 shoppers who reported witnessing a decline in customer service while shopping in stores over the last three months.

Some shoppers say they're increasingly disengaging from brick-and-mortar retailers, spending less time and money in-store, due to skimpflation. Specifically, 35% percent say they're spending less time in-store due to poorer customer service.

Nearly a quarter, moreover, report they are turning away from stores altogether—with digital channels absorbing some of the slack perhaps. But some retailers are reaping the benefits: bad experiences have caused 26% of the sub-sample to switch to a different retailer.

Notably, 27%, even among those who have noticed a decline in customer service, said skimpflation has not affected the way they shop at all. In other words: they notice, but it doesn't bother them—or, at least, they see little recourse they can take.

Speaking of shoppers and their customer service experiences, do you think shoppers would prefer:

- Higher prices and poorer customer service, or...

- Lower prices and better customer service?

You'll find the answer in an upcoming blog post. Stay tuned!

4. Do shoppers prefer higher prices, smaller packages, or poorer service?

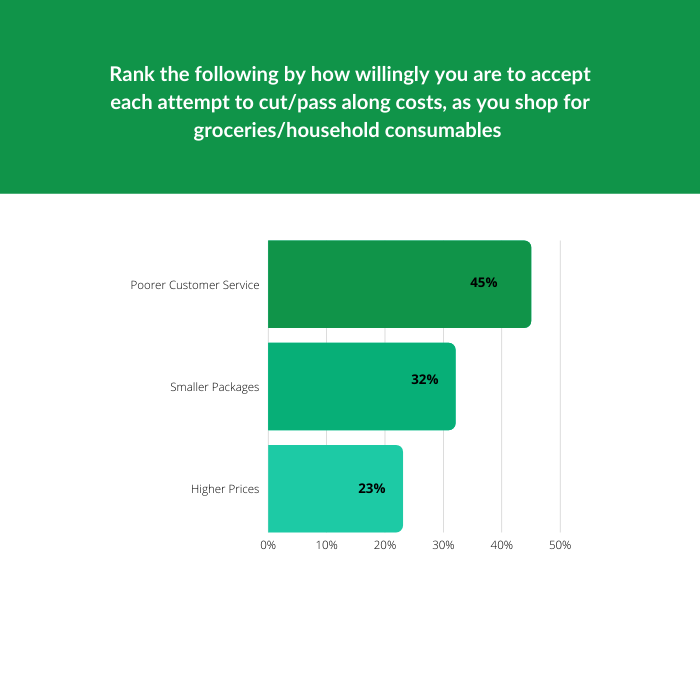

Pick your poison, we told shoppers. Well, not really. But if they had to endure inflation (higher prices), shrinkflation (smaller packages), or skimpflation (poorer service)—one and only one—while shopping in stores, which would they begrudgingly choose?

Overall, it seems companies are right to find innovative ways to pass along costs, instead of letting prices just run high.

Forty-five percent of shoppers identified poorer customer service as the “most acceptable” form of cost-cutting by companies, closely followed by smaller package sizes for the same price (32% ranked this as their #1 preference).

The least acceptable option? Price hikes.

Does this mean an advantage for discount retailers who already have a dominant position in the Canadian grocery landscape?

What's a Company to Do? 3 Suggestions

So how should retailers and/or brands respond to skimpflation?

Here are three practical suggestions:

1. Get visibility

You can't fix what you can't see, and if shoppers are seeing out-of-stocks, incorrect prices, and sloppy execution, you need to know about it.

Maybe its time for some store walks and audits.

The squeaky wheel gets the grease, and, if specific stores hear from you directly, you're much more likely to improve the situation for shoppers.

2. Look for opportunities

In the age of skimpflation, your customers are experiencing a new retail world, just like you are.

Understanding the shopper's world will allow you to pivot to meet their needs - building valuable goodwill in the process. Tools like surveys and shopalongs can help.

3. Keep track of your company's reputation

With inflation, shrinkflation, skimpflation, and supply chain issues all making the rounds, how's your company's perception currently fairing with shoppers and customers?

Retail Solutions for Any Challenge

No matter the challenge, Field Agent Canada has a solution. No skimping involved.

Get visibility in-store, gather relevant insights, drive trial of your products, merchandise shelves, and more.