The Inflation Situation: How Rising Prices Influence Grocery Shoppers

The causes and solutions that surround this issue are complicated, but one thing is painfully simple: prices are hitting everyday shoppers where it hurts: right in the wallet.

Few things influence shopper habits like price. As grocery brands scramble to understand how their customers are responding with every blow, we turned to the inside source on shopper habits: the shoppers themselves.

Field Agent asked 2,739 shoppers about how inflation has influenced and altered their grocery shopping habits over the last three months. Let's take a broad look at inflation in the grocery world (both in-store and online), learn how shoppers are responding, and explore a few tools that give brands a leg up.

How is Inflation Influencing In-Store Shoppers?

Check that price tag. In grocery stores across the country, shoppers are seeing price changes. And everyone's affected. In our survey of 2,739 shoppers, every single respondent shops for groceries in-store, with 61% visiting a brick-and-mortar grocery store multiple times per week.

Come along with us on a little drive to the grocery store, and tackle burning questions in three key areas: price, stock levels, and impulse purchases.

1. How are prices changing?

Have shoppers seen any price changes over the last three months? Unless you've been living under a rock since Christmas, you can probably guess the answer.

Surprise, surprise, prices are soaring. 95% of shoppers surveyed are well aware of higher prices, and over a quarter report paying "much higher" prices for their groceries. It's a pain point many can't afford to ignore.

Losing sales to incorrect prices? Learn more about monitoring prices in-store.

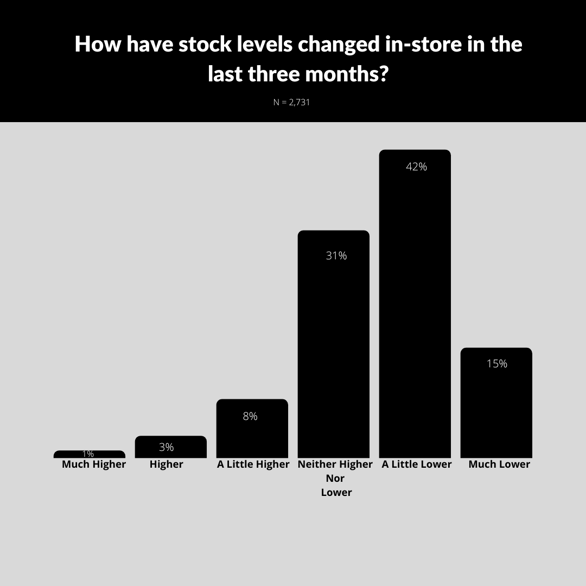

2. How are stock levels changing?

Thanks to supply chain shortages and pandemic-era panic buying, low stock levels have plagued shoppers since before inflation reared its ugly head (anyone else still flinch at the mere mention of toilet paper?) Let's check in with our trusty shoppers and see what they're noticing in the grocery aisle.

Compared with prices, stock levels are more of a nuanced issue. 12% of these shoppers report an increase in grocery stock, and about 31% say they haven't noticed any significant change at all. But a majority (57%) continue to perceive a drop in grocery stock compared to three months ago.

Why is this an important question for CPG brands? Simply put, customer loyalty drops with the purchasing power of their dollar (more on this later). Translation: if your product isn't on-shelf, penny-pinching shoppers are more than happy to swap for a competitor—especially if they'll save a few bucks doing so.

Is your product stocked up? Learn how to find out.

3. How are impulse purchases affected?

Ah, impulse purchases: the unplanned (but well-deserved) candy bar, soda, or other goodie snagged at the checkout lane. For shoppers, impulse purchases are an afterthought. But for many CPG brands, they're the prize-winning bread and butter.

When a dollar just doesn't go as far as it used to, frivolous purchases are the first to be kicked to the curb. 53% of shoppers surveyed said they're less likely to grab an unplanned treat while grocery shopping (19% are much less likely to do so).

Here's a snapshot of what shoppers had to say about it:

I shop with a list and make less impulse purchases. This can reduce waste at home and wasted money - Maxine S., Ontario

I make a weekly grocery list based on flyer offers and stick to it. We don't have room for impulse buys in our budget anymore and we tend to buy cheaper items as well. - Joanna D., British Columbia

Inflation means buying less impulse buys and us asking ourselves "do we really need that?" - Katelyn O., Ontario

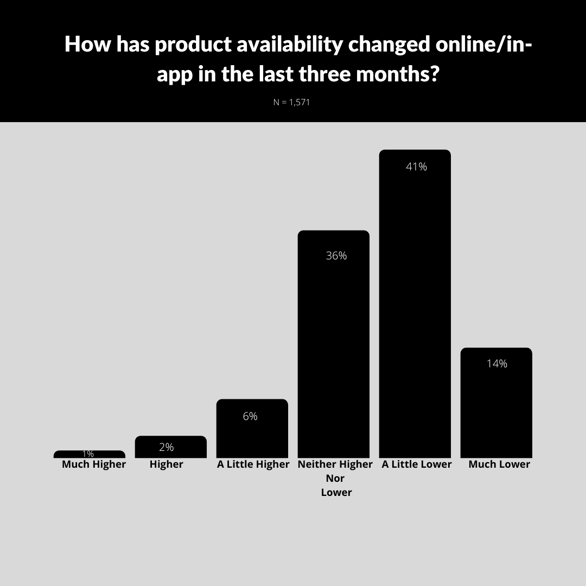

Inflation Online

Inflation isn't only affecting what goes into physical shopping carts—digital carts are also feeling the pressure. 58% of our shopper sample said they buy groceries online at least occasionally, and 7% make such purchases at least once a week.

It's a dirty little secret, but what's in-stock on grocery store shelves may not be available on retailer apps for pickup or delivery. We asked self-reported online grocery shoppers if they've noticed any availability changes.

As on-shelf, so in-app. A majority of shoppers have noticed a downward trend in availability as they shop for groceries online or in-app. For CPG brands, that means more substitutions or missed sales.

I've been adjusting my grocery list, buy more cost efficient products and buy when on sale. – Irene W., British Columbia

I either have to buy in bulk in order to have groceries available or buy what's on sale and work with that. – Jay S., Ontario

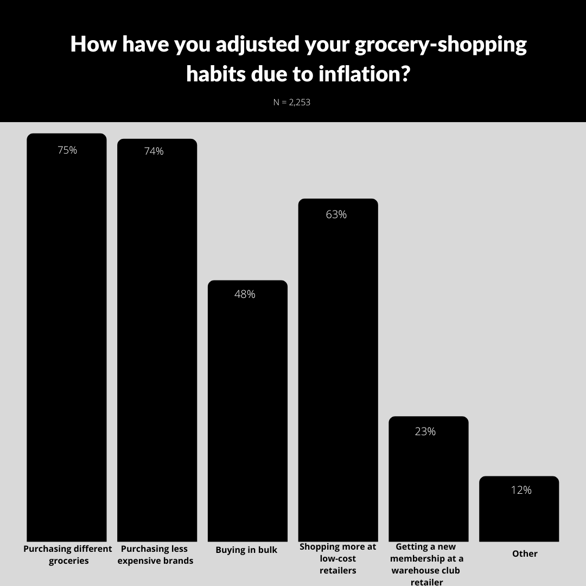

How Are Shoppers Changing?

Now for the million-dollar question. We've explored what grocery shoppers are experiencing, both in-store and online. In light of inflation, are those changes influencing the way they shop for groceries?

The answer: a resounding "yes." 82% of shoppers say they've adjusted their grocery-shopping habits due to inflation. We asked that subset to get a little more specific.

It's worth repeating: when funds get tight, shoppers change what they buy. 74% of shoppers say they're switching brands to save costs, and 75% are buying different groceries altogether (less meat, for example).

Discounts and coupons are looking more enticing to shoppers as well. 23% say that inflation has even influenced them to pick up a membership at a warehouse club like Costco.

To lower costs of my groceries I compare flyers from different food retailers and price match, use coupons, and being a member of some retailers to collect points to use on groceries.. – Ann L., Alberta

Inflation has influenced my grocery purchasing habits that now I am extra careful in how much brand names I purchase. I also try to go to discount grocery stores for more of my grocery purchases. I also look for better deals through apps and try to use coupons and discount codes more often.. – Maryann L., Ontario

What's a Brand to Do?

The takeaway for CPG brands: shoppers are increasingly open to purchasing from competitors. And when loyalty is low, every sale counts.

But shoppers aren't the only ones tightening their belts. As sales dip for many brands, the cost of boots on the ground to fix pricing errors and check out-of-stocks can feel overwhelming.

But here's the good news: low-cost, high-yield solutions for these challenges (and many more) exist to help every CPG brand weather inflation. Companies of all sizes, from Fortune 500 juggernauts to mom-and-pop brands, trust Field Agent to inspect prices, double-check out-of-stocks, and even boost e-commerce sales. All with just a few clicks.